To Ease Supply Pressures, OPEC-Plus Targets Further Crude Production Increase - Natural Gas Intelligence

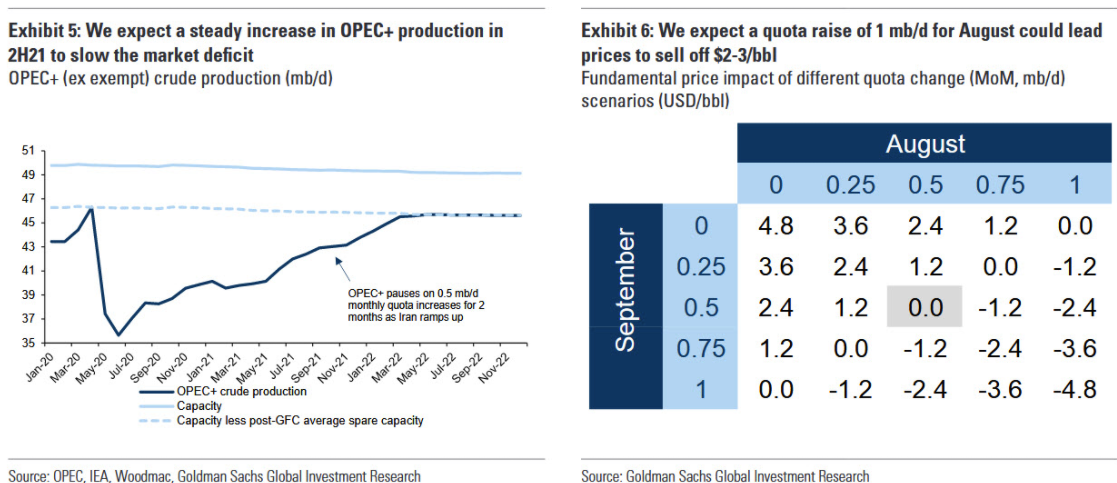

Goldman Sachs sees lower oil prices unless there are deeper Opec production cuts | South China Morning Post

Goldman Sachs sees elevated OPEC pricing power, $100 per barrel by April 2024 after supply cut - The Globe and Mail